When Better Products Hurt Profits: The Hidden Costs of Quality in Retail

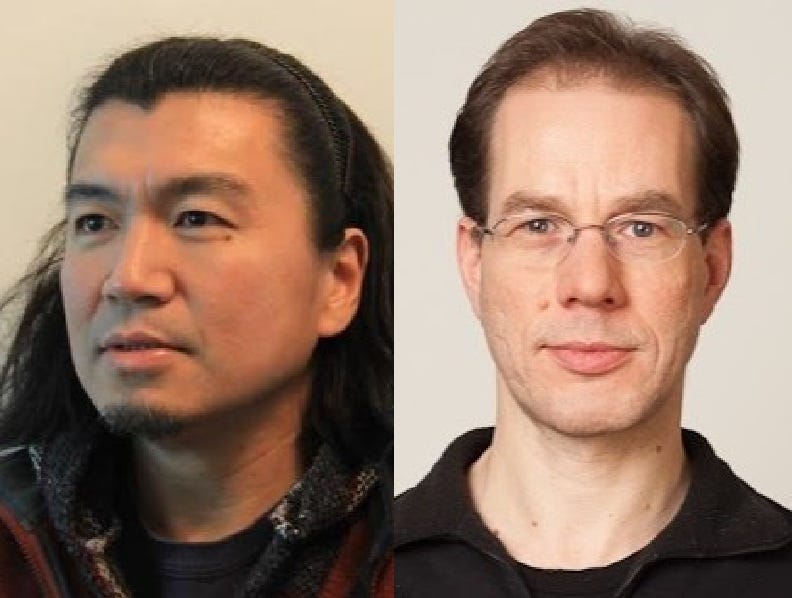

Shin & Strausz: "Demand-Investment in Distribution Channels" CRC Discussion Paper No. 553

Should the world’s largest PC manufacturer, Lenovo, invest in faster computers? Should hotels invest in room renovations before listing on Booking.com? The obvious answer seems to be “yes.” Better products attract more customers and allow manufacturers to command higher prices.

But when these products are sold through independent retailers or platforms, the answer can surprisingly be “no.” New research by Dongsoo Shin (Santa Clara University) and Roland Strausz (HU-Berlin, Project B02) shows that manufacturers sometimes profit by deliberately limiting product quality or restricting market access.

The counterintuitive finding stems from a fundamental problem in vertical markets: double marginalization. When manufacturers sell through independent retailers, both parties mark up prices, leading to prices that are too high and sales that are too low.

But here’s the twist: when a manufacturer improves product quality, it strengthens the retailer’s bargaining position. A better laptop gives the retailer more leverage to demand lower wholesale prices from Lenovo. If the rent concession Lenovo must make exceeds the benefit from higher demand, Lenovo loses money from the quality improvement.

Consider Lenovo selling laptops through a retailer to both tech enthusiasts (willing to pay $2,000) and casual users (willing to pay $1,000). If Lenovo improves the laptop by adding a better graphics card, suppose only tech enthusiasts value it more. This improvement makes it more tempting for the retailer to raise prices and target only the high-end segment. To keep the retailer focused on the mass market, Lenovo must lower wholesale prices. This concession is more costly than the quality improvement generates. Result: Lenovo is better off producing the inferior product.

Using mechanism design theory, the authors study this problem in general and identify the crucial insight: only specific parts of demand matter for investment decisions. Demand at the target retail price benefits manufacturers, while demand at prices where retailers are tempted to deviate hurts them. This precision explains why conventional economic analysis often gets investment incentives wrong. Standard models examine the entire demand curve, obscuring which specific points actually drive profits.

The findings help explain observed business practices. Many PC manufacturers supply premium models exclusively through select retailers, while budget products go to mass-market chains. Hotels often list lower-quality rooms on platforms while reserving premium rooms for direct bookings. What looks like simple market segmentation may actually reflect sophisticated management of the double marginalization problem. Sometimes limiting product quality is the profit-maximizing strategy—a hidden cost of distribution channel structure that ultimately means consumers get lower-quality products than manufacturers could profitably produce.

Link (pdf): Demand-Investment in Distribution Channels